What the Sunsetting of Google’s Universal Analytics Means for Law Firms

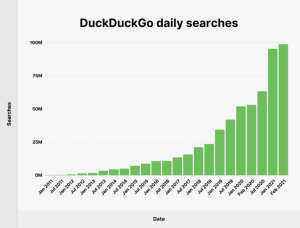

Mark your calendars: on July 1st, 2023 Google will stop registering data with Google Analytics version: Universal Analytics. (Note if you are using Google 360 – you have till October 1, 2023 to make the switch.) While it’s not time to panic (yet), there are very very significant changes coming – primarily around an increasingly lack of specificity with regards to both traffic sources and (more importantly) conversion metrics. Google is making this change ostensibly due to increased privacy concerns by the general public. You may have even heard those radio ads from long-shot Google competitor and vocal privacy advocate Duck Duck Go – whose market share has grown to 2.5% of the US market. The new version of Google Analytics (unimaginatively titled GA4) is heavily focused on privacy and instead of enabling individual linear tracking, it uses machine learning to model consumer behavior across multiple platforms, devices, and platforms for attribution. Put differently, Google is going to provide GA4 users with their best guesses of how consumers behave instead of actually tracking (and exposing) that individual behavior. This isn’t the first time Google has reduced visibility into consumer behavior under the veil of increased privacy concerns… if memory serves correctly in 2013, Google replaced most of the very granular keyword data in Analytics with “not provided” – driving internet marketers who had been obsessing over individual keyword performance crazy.

The obvious elephant in the room concern here is that the vast majority of marketers are now going to be fed a steady stream of what Google believes (or would like you to believe, depending on your level of cynicism) is generating consumer interest and behavior across multiple platforms. For example, you may now learn that Google tells you that watching YouTube videos is responsible for driving a portion of your website traffic that formerly was entirely attributed to SEO. This can be viewed as a genuine attempt to inform marketers about the effectiveness of cross-channel promotion and/or a craven flagrant bid to drive more YouTube advertising revenue. This becomes increasingly complicated when you consider the platforms for which Google does not ostensibly gather data. How does the password-protected community on Facebook play into website traffic for example? (See my post on Dark Social for more on attribution issues that already exist and are only going to get more complicated). The less cynical reader may also accept the marketing positioning coming from Google – that seamless cross channel reporting integration will provide greater insights and therefore better ROI. Which, of course, assumes that your advertising uniquely has access to this tool, but frankly, that same tide will be rising for everyone so…

How Does This Affect Marketing Efforts for Law Firms?

In legal, some marketing channels are extremely linear, direct, and trackable – think PPC for traffic tickets as an example, in which users typically search, click, call, and hire in a single session. Other hiring decisions are much more indirect and take place over time – think divorce where many users research options over time through a variety of offline and online channels and referral sources before connecting with (typically multiple) law firms. Obviously, this linearity (or lack thereof) differs dramatically by practice area as well as marketing channel. The less linear the consumer’s behavior, the more real, actionable data is removed from a law firm’s analytical review.

Additionally, the modeling is limited to Google’s visibility into the world, which is (almost) entirely online. How is Google going to model consumer behavior for law firms that rely heavily on offline promotion – TV, Radio, Billboards, etc.? What of those firms who have a significant portion of their business driven by industry referrals? While the volume of brand searches may provide some layer of online insight into the offline experience, I suspect the accuracy of machine learning in modeling non-machine behavior is limited at best. Finally, I also suspect there will be even further restrictions on retargeting advertisements – making the importance of gaining permission to continue to connect with a prospect during their first trip to your site a huge priority.

What this Means for Mockingbird Clients

To be frank, this switch is going to more dramatically impact Mockingbird clients than most other legal market agencies, simply because we’ve gone further at reporting into the sales funnel, instead of just stopping at leads (i.e. how many consultations and clients are attributed to which marketing channels generating instead of just leads.) My blunt take is that this increases the value of our Full Funnel Reporting because leads-only reporting is going to get murkier and less directionally accurate. Yeah, that’s a back-handed self-promotional statement, but it’s also true. Since Google’s announcement, we’ve added GA4 tracking code to all clients on Standard (formerly Starter) and Full Funnel (formerly Aggressive Growth) reporting infrastructure. We’re currently rolling this out to all clients on the legacy reporting infrastructure and those on our simple hosting/maintenance. This means our clients will have at least a years worth of legacy data populating the new system and we’ll have a solid period of time to explore limitations and find workarounds for the new platform.

Our next step is to see what gaps we have in our reporting that cannot be filled with Google’s machine learning as well as integration problems. The most concerning (for us and many firms) is how this will impact the very personal, private data collected by dynamic phone tracking services such as CallRail, as well as automated source attribution for many of the more sophisticated Intake Management CRMs (HubSpot, Lawmatics, Litify, Clio Grow, LeadDocket, etc.). A known issue is that conversion data (like that from very useful CallRail does not Pass through to GA4. We are actively working with CallRail on how to handle this. We are exploring alternative analytical packages that may either replace or supplement GA4 – Adobe Analytics, Fathom, and Adverity. Finally, some of the CRM systems have analytics built directly into them – including two of our go-to favorites, Hubspot and Lawmatics. Stay tuned, I suspect over the next 10 months dramatic changes from other analytics providers as they seek to swoop in to fill this data vacuum.