Study: Google Ads Costs Increase by 42% during COVID Crisis

The massive shifts in consumer behavior combined with attorneys carefully extending their cash flow window has created a seismic shift in the economics of Google’s already competitive PPC advertising market. Mockingbird took a deep dive into the performance (carefully defined…. keep reading) of a random sample of 50 our our PPC clients to ascertain just how this has impacted the market. The net result:

A 42% increase in average cost per inquiry; although this is heavily colored by practice area and geography and individual firm strategies.

Methodology

Given the massive flux in the market, it’s impossible to isolate any given variables for a truly scientific study – there are simple too many exogenous variables impacting any given campaign. In addition, Mockingbird has been very hands on during the COVID Crisis, especially with our PPC campaigns – adjusting models to (try) to fit the changing dynamics of the market along with our lawyers’ individual business reality. Some clients added campaigns to capture marketshare, others pulled back completely to preserve cash flow. Taking into account all of these moving parts, the average overall cost per inquiry across the legal advertisers who stayed in the market between February and the end of April increased by 42%. Monthly campaign budgets ranged from $700 to over $100K. We looked at the first two weeks of February as a pre-COVID benchmark and compared it to the last 14 days (ending yesterday). While we looked at a variety of different metrics the only one that really matters is cost per inquiry – and inquiries defined by a (first time) phone call, text, chat or form fill to an attorney.

Sidebar: Branded Advertising and Devious Marketing Agencies

In addition, for a true analysis, we pulled out branded advertising – i.e. those campaigns that bidding on the firm’s name or the name of attorneys within the firm, because these clicks and inquiries aren’t truly incremental conversions. Note this is one of the dirty tricks terrible agencies use to inflate their value…. i.e. counting an inquiry for “Attorney Bill Smith” as being as valuable as one for “truck accident lawyer Atlanta”. In addition, these branded conversions are extremely cheap and are used as metrics filler by agencies to inflate their numbers. In our study, branded campaigns generated inquiries at just over $10 per.

Oh – and if you don’t have access to your Google Ads account, you might ask yourself, “what does my agency not want me to see? are they hiding their performance? are they hiding my actual advertising spend?” You are a lawyer. Be a smart marketer too. Smart lawyers don’t let their agency hide data.

Results, Conclusions and Anecdotes

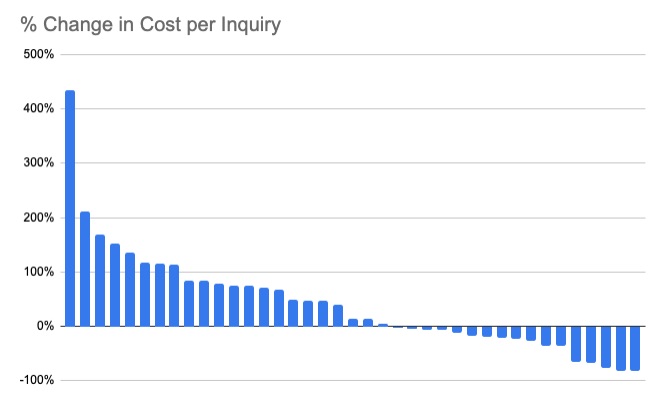

While the average advertising campaign saw cost per client numbers rise by 42%, there was an extremely wide distribution of the results – with fully 17 of the study group actually seeing a decline in cost per client data. 4 of the top 5 savers in this study were mixed firms how dropped Personal Injury entirely and retained budgets with other practice areas – so again, not a purely scientific study, but my goal here is to help our clients survive, not publish studies. Interestingly, of the top 9 advertisers who experienced the highest increase in cost per client, only two were PI – the others being in Tax, Immigration, Family and Social Security.

Surprisingly, CPC rates actually declined – prior to COVID, across all non-branded average CPCs were $15.55 and during the past two weeks, this number has actually declined to $12.80. I suspect this is attributable to some degree to the changes in makeup of practice areas (attorneys dropping expensive PI clicks) but to some extent, is also due to competitors pulling out of the market. So if CPC rates are dropping, why have costs actually increased? The answer lies in a decrease in the inquiry rate, the percentage of people who contact a lawyer after clicking on the ad. People are simply contacting lawyers 14% less frequently than they were before – which means there are more tire kickers, researchers and those that frankly are concerned about the cost of hiring a lawyer in this very uncertain economic reality.

Other thoughts:

- One PI client, flush with cash from a recent settlement aggressive expanded his spend by 6.2x – going from dabbling to a much more aggressive approach including branded display ads has a tenfold increase in inquiries at a 35% lower cost per inquiry. His market conditions just favored this approach.

- The practice area that was most likely to completely abandon the market post COVID were Criminal Defense attorneys – especially campaigns focused around DUI.

- Four of the 50 advertisers actually entered the market during this period.

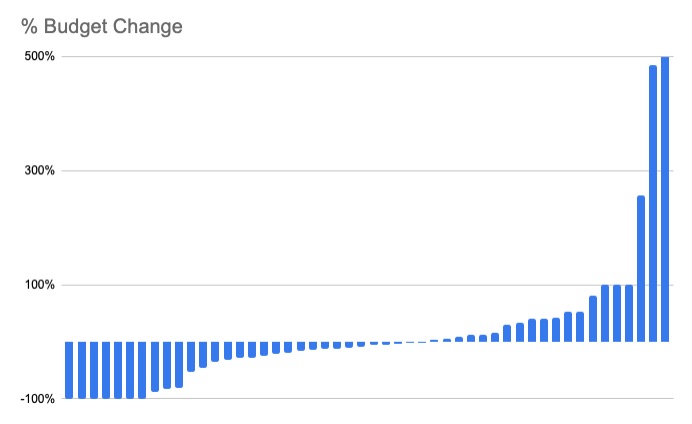

- 60% of the study changed their budgets by more than 20%…. if you haven’t adjust your budgets to match the market, now might be a good time to do so. The graph below shows a very wide spectrum in the changes in budgets.

Learn More

If you’d like to dig even deeper into the data, we’re reviewing the raw data with our Mastermind group, held on Thursday afternoons. Apply to join us here: CORONA Crisis Mastermind.

Or join me and Google’s Sherri Healy next Wednesday, May 6 at 10:00 PST for a webinar. Register here: The Changing Economics of PPC in Legal.